In the fast-evolving world of finance‚ microservices architecture has emerged as a transformative approach‚ particularly within the realm of banking. This architectural style enables financial institutions to enhance their services‚ improve scalability‚ and foster innovation through Open API banking.

Understanding Microservices

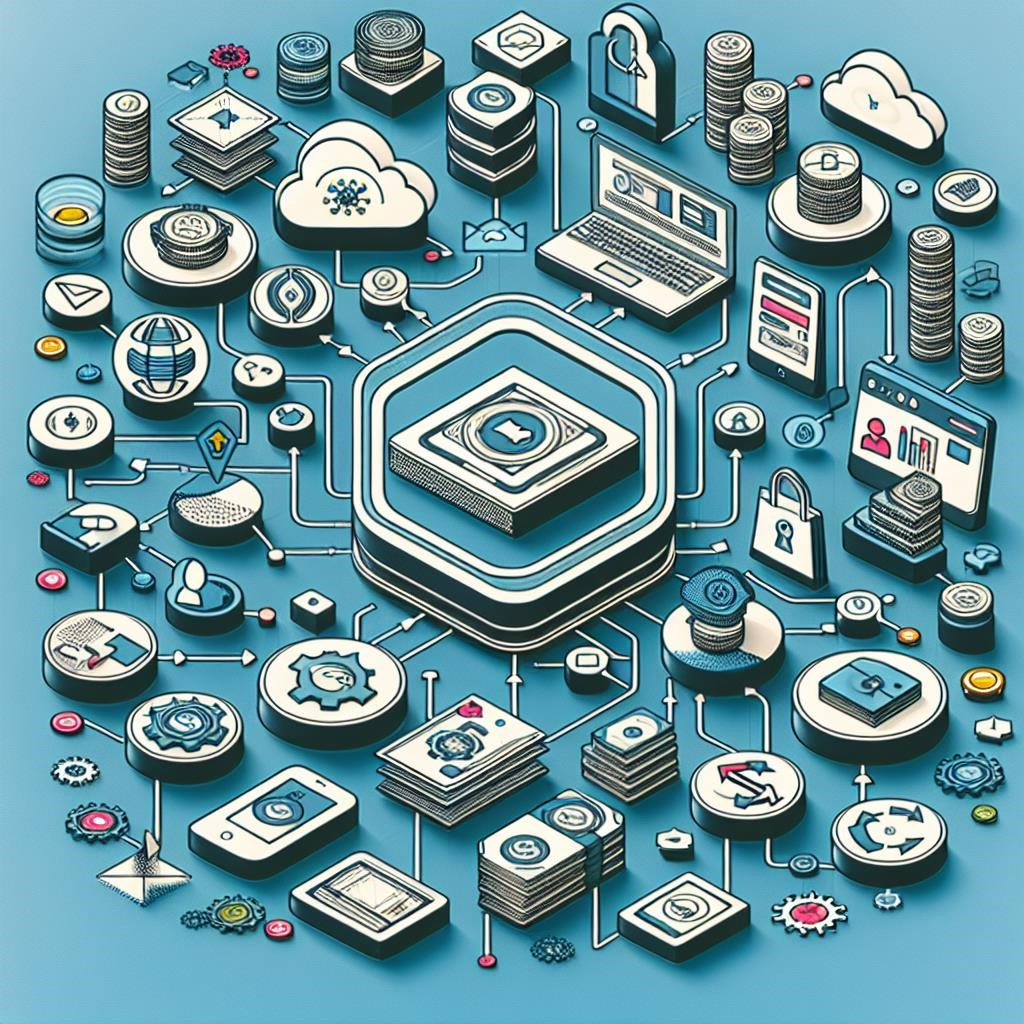

Microservices refer to an architectural style that structures an application as a collection of small‚ independently deployable services. Each service runs in its own process and communicates through lightweight mechanisms‚ often HTTP-based APIs.

Advantages of Microservices in Banking

- Scalability: Each component can be scaled independently‚ allowing banks to allocate resources more efficiently.

- Resilience: Failures in one service do not necessarily compromise the entire system‚ enhancing overall system reliability.

- Faster Time to Market: Microservices allow teams to develop‚ test‚ and deploy features more rapidly‚ responding to market demands swiftly.

- Technology Diversity: Different services can be built using different technologies best suited for their specific tasks;

Open API Banking

Open API banking refers to the practice of providing third-party developers with access to bank data and services through APIs. This enables the creation of new financial products and services that can enhance customer experience.

Microservices and Open API Banking Synergy

The combination of microservices and Open API banking creates a robust framework for innovation. Here’s how:

- Enhanced Collaboration: Banks can easily integrate with fintech companies and other partners‚ fostering collaboration.

- Improved Customer Experience: Personalized services and streamlined applications can be built to meet customer needs effectively.

- Rapid Prototyping: New financial products can be developed and tested quickly‚ promoting a culture of innovation.

Challenges in Implementation

While the benefits are clear‚ adopting microservices and Open API banking is not without challenges:

- Security Concerns: Opening APIs increases the attack surface‚ necessitating robust security measures.

- Regulatory Compliance: Financial institutions must navigate complex regulations that govern data sharing and privacy.

- Integration Complexity: Integrating legacy systems with new microservices can be technically challenging.

The Future of Banking

The future of banking lies in the ability to adapt and innovate. Microservices‚ combined with Open API banking‚ provide a pathway for banks to remain competitive in a landscape increasingly dominated by agile fintech companies.

As the banking sector continues to evolve‚ embracing microservices and Open API banking will be crucial for institutions aiming to enhance their offerings‚ improve operational efficiency‚ and foster customer loyalty. The journey may be complex‚ but the potential rewards are significant.